trust capital gains tax rate 2022

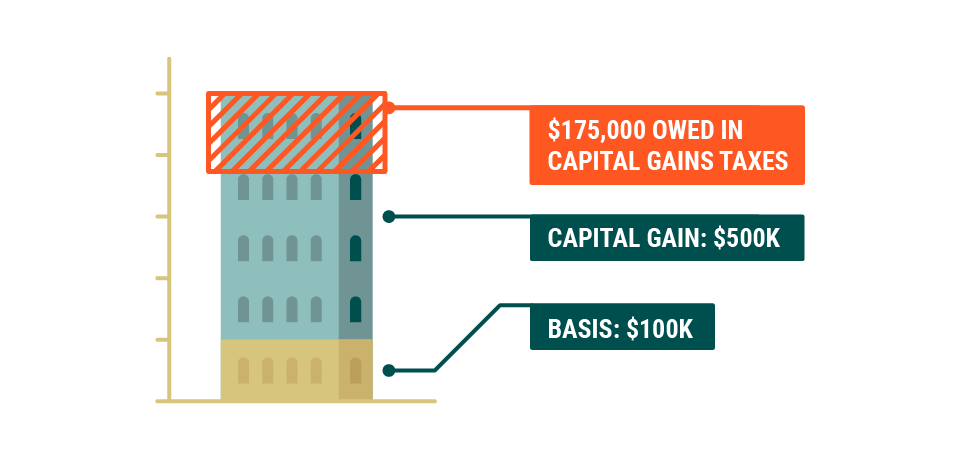

10 of 2650 all. At basically 13000 in income they hit the highest tax rate.

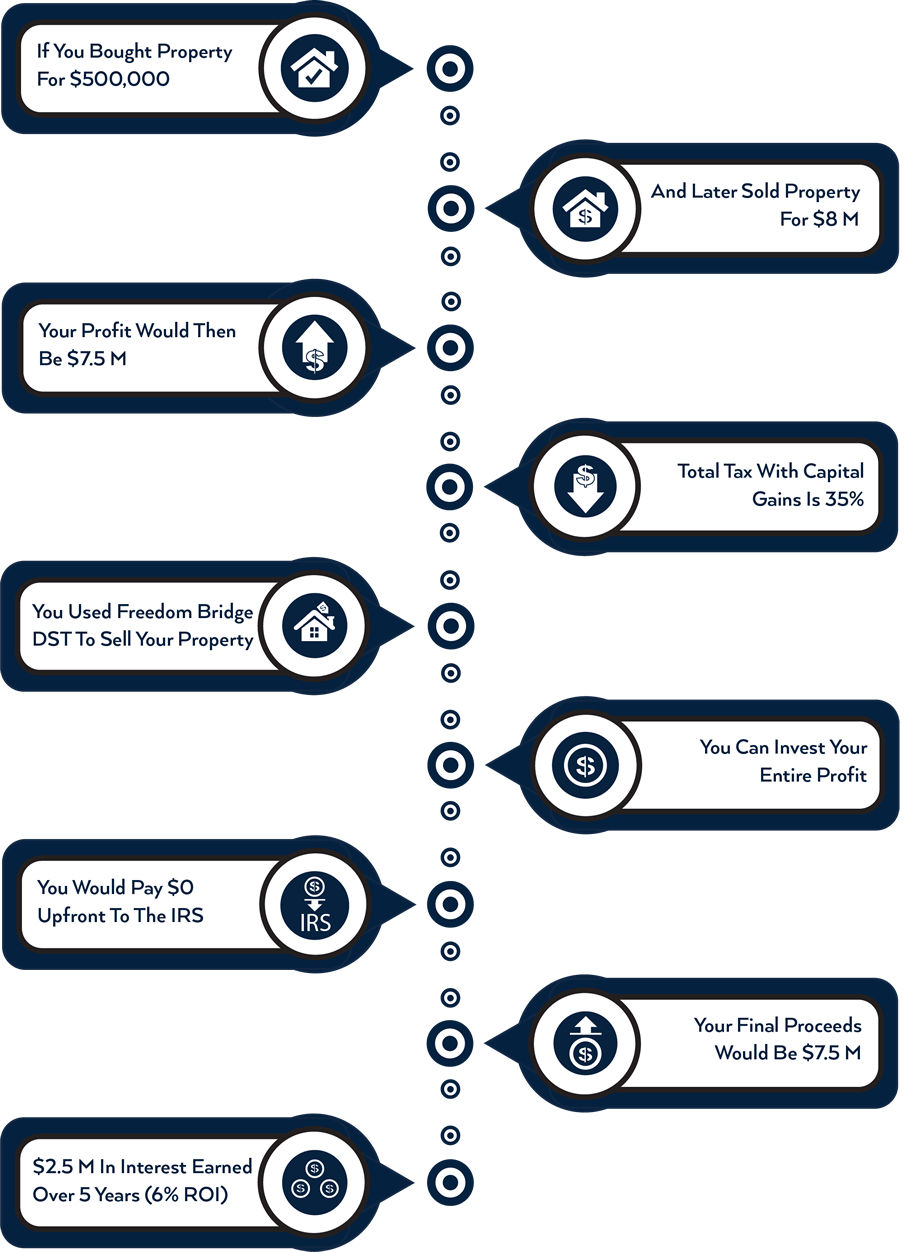

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Events that trigger a disposal include a sale donation exchange loss death and.

. However long term capital gain generated by a trust still. The IRS typically allows you to exclude up to. At just 13050 in taxable income trust tax rates are 37 plus the 38 tax imposed with the Affordable Care Act.

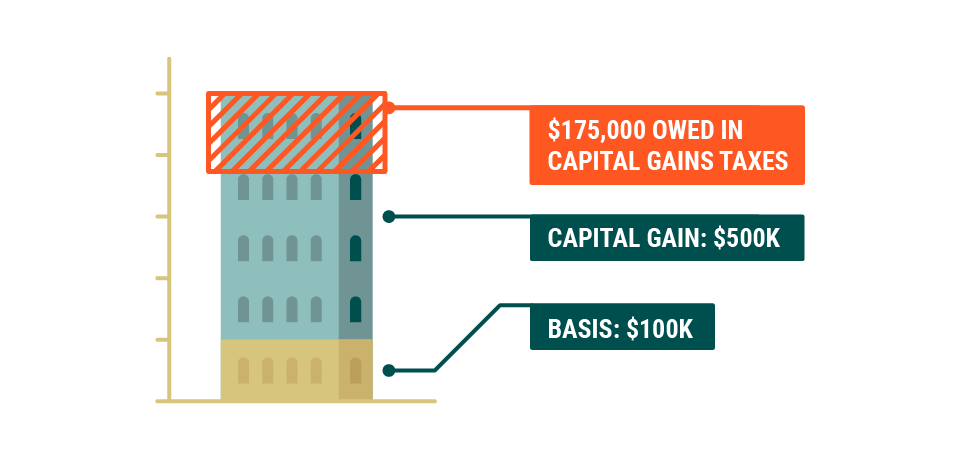

Note however that these. 2022 Long-Term Capital Gains Trust Tax Rates. 250000 of capital gains on real estate if youre single.

Irrevocable trusts have a major tax issue. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. 2022 Federal Long-Term Capital Gain Rates for Estates and Trusts.

Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income. The financial impact of this tax grows in correlation with the size of your household income. The maximum tax rate for long-term capital gains and qualified dividends is 20.

4 rows The IRS has already released the 2022 thresholds see table below so you can start planning for. The tax rate for capital gains is as low as 0 percent and as high as 37 percent based on your income and whether the asset was a short-term or long-term investment. For trusts in 2022 there are three long-term capital.

There are seven federal income tax rates in 2022. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year. The standard rules apply to these four tax brackets.

For example if you purchased real property for 400000 and sold it ten years later for 500000 you would realize a gain of 100000. Capital gains and qualified dividends. You would owe capital gains tax on your profit of 5.

The remaining amount is taxed at the current rate of Capital Gains Tax for trustees in the 2021 to 2022 tax year. So for example if a trust earns 10000 in income during 2021 it would pay the following taxes. In other words if you are falling in 28 tax bracket short term capital gains in.

The top marginal income tax rate. Long-term capital gains are taxed at the rate of 0 15 or 20 depending on a combination of your taxable income and marital status. Gains from the sale of capital assets that you held for at least one year which are considered long-term capital gains are taxed at either a 0 15 or 20 rate.

20 for trustees or for personal representatives of someone who. 500000 of capital gains on real estate if youre married and filing jointly. Long-term capital gains are taxed at lower rates than.

Qualified dividends and capital gains on assets held for more than 12 months are taxed at a lower rate called the long-term capital gains rate. For tax year 2022 the 20 rate applies to amounts above 13700. Theres no capital gains tax to pay and unused losses of 3000 to.

When you dispose of chargeable assets you will pay 20 Capital Gains Tax if you are a higher or additional rate taxpayer. Includes short and long-term Federal and State Capital. For single tax filers you can benefit.

Through capital losses trusts can offset capital gains. Short term capital gains are taxed at the same tax rate that is applied to your normal income. Determining when capital gains taxes are.

4 rows Long-Term Capital Gains Taxes. The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. Trust Capital Gains Tax Rate 2022.

And as mentioned earlier they can carry over excess losses beyond the cap to future tax years. Again if the taxable gains plus your income remain in. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

What Is Investment Income Definition Types And Tax Treatments

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

What Is Investment Income Definition Types And Tax Treatments

How To Pay 0 Capital Gains Taxes With A Six Figure Income

What Is Investment Income Definition Types And Tax Treatments

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Capital Gain Tax Calculator 2022 2021

Capital Gains Tax On Gifts Low Incomes Tax Reform Group

Capital Gains Tax Deferral Capital Gains Tax Exemptions

How Does The Personal Representative Deal With The Income And Capital Gains Arising After The Deceased S Death Low Incomes Tax Reform Group

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

Taxation Changes In Indonesia Under Tax Regulation Harmonization Law

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Income Tax Rates For Fy 2021 22 Ay 2022 23 Fy 2022 23 Ay 2023 24

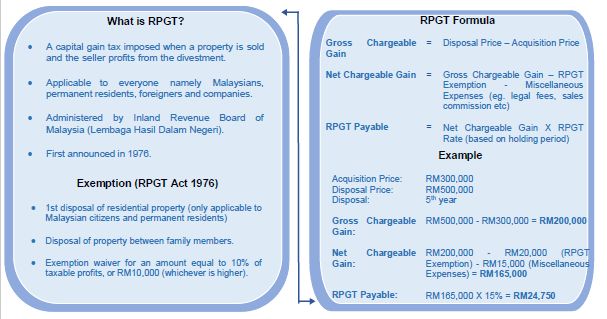

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

/ScreenShot2021-02-10at4.22.05PM-66a7ee46923a4474b907ce6f25ca8bce.png)

Form 2439 Notice To Shareholder Of Undistributed Long Term Capital Gains Definition